CAC is simply the price to acquire a new customer. Should you pay $100 or $500 per new buyer?

With CAC, you can see clear returns on marketing campaigns. It helps you find the most valuable customers and make smart budget decisions.

Low CAC means profitability. High CAC means waste. To thrive, you need the right balance.

This article will answer your questions about customer acquisition cost in simple terms.

In this article, you’ll learn:

- How to accurately calculate your CAC

- Smart ways to reduce it

- How customer experience impacts it

- Tips to improve your customer acquisition strategy

And powerful ideas to boost your ROI.

If improving customer acquisition cost for real results is vital for your business, you should read every word on this page.

Let’s dive in and start optimizing your marketing today!

How to Calculate Customer Acquisition Cost

You could get so busy running your business that you don’t have time to crunch complex numbers. But trust me, calculating the cost of acquiring a customer is super important.

This metric is like an X-ray of your marketing budget, exposing where the money is really going.

The customer acquisition cost formula is straightforward:

CAC = Total Acquisition Costs / Number of New Customers

Now, let’s throw more light on CAC calculation to make things clearer.

Example calculation with sample numbers

Let’s say your company spent $100,000 last month on sales and marketing. And through these efforts, you acquired 1,000 new customers. Your CAC would be:

$100,000 / 1,000 = $100

So, your customer acquisition cost is $100. That means you invested $100 on average for each customer acquired last month.

To determine your total acquisition costs, account for all expenses related to sales, advertising, and marketing that are directed at customer recruitment.

The key is to include every cost incurred to acquire new customers. Tally these expenses over a set period, such as monthly or quarterly. Then, divide the total cost by the number of new customers gained during that same period.

Types of Costs to Include in a CAC Formula

Let’s explore the various costs that go into customer acquisition cost.

Marketing Campaign Costs

All costs associated with marketing campaigns aimed at customer recruitment should factor into your CAC. This includes marketing expenses like:

- Paid search ads (e.g., Google Ads)

- Social media advertising

- Content marketing

- Email marketing

- Display and video ads

- Direct mail

- Print ads

- TV and radio spots

- Billboards

- Trade shows and events

Add up spending on creative work, ad placement, print materials, giveaways, and any other campaign expenses.

Sales Team Costs

These refer to the monies you invest in your sales team’s efforts to convert leads into paying customers. They include:

- Sales staff salaries and commissions

- Sales software, tools, and systems

- Sales training and coaching

- Travel and entertainment costs

Sales Collateral Expenses

CAC also incorporates amounts spent on collateral used by your sales team. This includes:

- Product sample costs

- Webinars

- Catalogs, flyers, and brochures

- Presentation materials

- Proposals and contracts

- Sales scripts

Customer Onboarding Costs

The expenses involved with onboarding new customers also contribute to CAC. For example:

- Welcoming gifts or incentives

- Orientation packages

- Training and support

- Account setup and integration

Factor in what’s spent to smoothly transition customers from prospects to active clients.

General Overhead

A share of general overhead applies to the total cost of acquiring customers. Consider including:

- Salaries of management and administrative staff

- Office space and supplies

- Utilities

- Equipment and IT infrastructure

- Legal, accounting, and consulting fees

What the CAC Metric Means to You and Your Business

Now that you know how to calculate CAC, what does this metric actually tell you? And how can you use CAC to guide business decisions?

At its core, CAC shows how much money you’re spending to convince prospective customers to do business with you. It rolls up all marketing, sales, and onboarding expenses associated with landing each new client.

CAC helps you gauge the overall efficiency of your customer acquisition process. A low CAC indicates you’re able to attract and convert new customers cost-effectively. As CAC rises, it suggests your acquisition drive is becoming less efficient. It costs you more to generate each customer.

Monitoring CAC also helps identify the most profitable customer segments for your business. You may find it costs significantly more to acquire Enterprise vs. SMB clients. High CAC could signal certain markets or niches no longer make fiscal sense to pursue.

In this way, CAC guides where to focus sales and marketing dollars for optimal ROI. You can double down on channels and campaigns that deliver new customers at low costs. And reduce spending on less efficient acquisition efforts with marginal benefits.

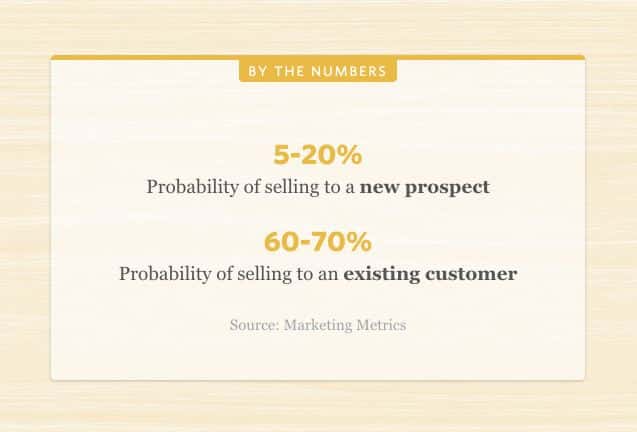

customer acquisition cost also feeds into pricing strategy. For example, if your CAC to attract small business customers is $400, you need your pricing and gross margins to support this. Acquiring a client for $400 only makes sense if their lifetime value exceeds this. Likewise, a CAC of $2,000 is only feasible if customers will generate more than this in revenue.

So, customer acquisition cost helps determine appropriate pricing points. And whether your profit margins can sustain a particular CAC level across your customer base. When used alongside other data, CAC provides actionable intelligence for maximizing growth and profitability.

How CAC is tied to another important metric: Customer Lifetime Value (CLV)

One key metric that’s directly impacted by CAC is Customer Lifetime Value (CLV). CLV refers to the total revenue generated by a customer throughout your entire relationship – from initial purchase to end of patronage.

CLV and CAC are intrinsically linked. Your CAC forms an “investment” to acquire new customers. And CLV represents the “return” on that investment in the form of future earnings.

As a rule of thumb, your CAC should only be a fraction of the average customer lifetime value. Generally, you want CLV to be at least 3 – 5 times greater than CAC. This ensures your customer acquisition spending will pay for itself several times over.

Let’s look at an example:

- CAC to acquire a customer is $300

- Average customer value is $2,000/year

- Customers remain active for five years on average

- So CLV is $2,000 x 5 years = $10,000

Your CLV of $10,000 is over 33X your CAC of $300. This signals you have plenty of room to spend on customer acquisition. And you’ll still net substantial profits from newly acquired clients.

Now imagine a different scenario:

- CAC is $300

- CLV is $400

In this case, the investment to acquire the customer exceeds the revenue they generate. Acquiring unprofitable customers like this can quickly destroy your business.

Regularly comparing CAC vs. CLV helps avoid this pitfall. If CAC climbs and approaches CLV, it’s time to optimize your marketing funnel. Improve conversion rates, target higher-value clients, or create upsells to increase CLV. Failing to do so means acquiring customers that ultimately diminish your bottom line.

How to Improve Customer Acquisition Cost

Now that you appreciate the significance of CAC, let’s explore proven methods for reducing it. With good marketing efforts, you can cut your cost per acquisition substantially. Here are some effective tactics you should consider:

Improve Conversion Rates in Your Sales Funnel

Think of your sales process as a funnel. Prospects enter the wide top of the funnel, and only a fraction convert to become customers at the bottom.

Any improvements made to the conversion rate will decrease CAC. For example, if 5% of prospects currently convert to customers, raising this to 7.5% means acquiring 50% more customers for the same acquisition spend.

Test different approaches to identify friction points in your funnel and boost conversions. Look at ways to optimize the readiness of leads entering the top of the funnel. When your leads are more sales-ready, you will get higher conversion rates and lower CAC.

Identify and Eliminate Inefficient Marketing Channels

Carefully track and analyze results from each customer acquisition channel. Identify low-performing efforts that provide little return on your marketing spend.

Redirecting budgets away from ineffective channels toward profitable ones is a great way to lower CAC. You gain more customers for the same total acquisition spend.

Set targets for key metrics like cost per lead and evaluate regularly. Cut any initiatives not hitting targets after testing improvements.

Offer Compelling Promotions and Discounts Selectively

Promotions and discounts, when used judiciously, can reduce customer acquisition cost. But deep, long-running discounts often destroy value and profitability.

Instead, offer targeted promotions with a set end date. Give new subscribers or customers a 10% discount for the first three months. This incentivizes quicker purchase decisions and helps offset the initial customer acquisition cost.

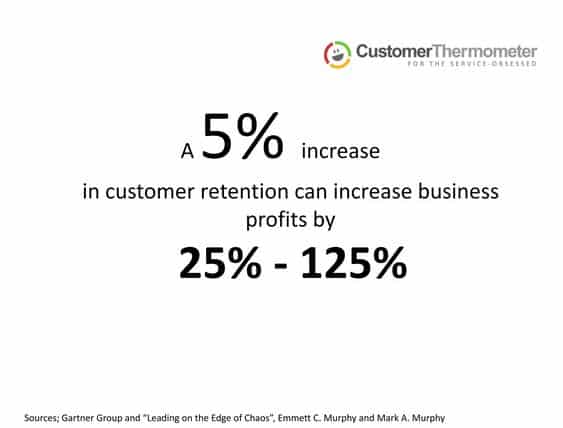

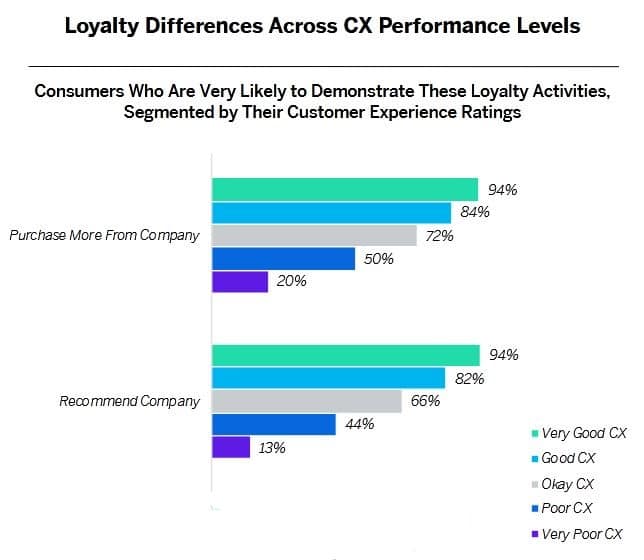

Promotions tied to referrals also lower CAC by harnessing word-of-mouth marketing. For example, give a 10% discount to the buyer and referrer. The incentive gets existing customers to spread the word for free. According to this report, 94% of customers in the US will recommend a company if they think their service is ”very good.”

Streamline and Simplify Your Sales Process

Lengthy, complex sales cycles invariably increase customer acquisition cost. The more hoops prospects must jump through, the more they’ll drop out before converting.

Analyze each step of your sales process. Remove unnecessary steps that complicate or delay purchase. Also, assess your sales collateral. Cutting overly long sales decks and marketing documents to just key pages reduces CAC.

The easier and faster it is for a customer to purchase your product, the lower your customer acquisition cost will be. Evaluate your sales process from the prospect’s eyes. Remove any speed bump within your control.

What is a Customer Acquisition Specialist? Plus Why You May Need One

Assigning a dedicated staffer to manage customer acquisition can significantly boost results and cut CAC.

A customer acquisition specialist oversees the end-to-end process of generating and converting new prospects. Responsibilities of a CA Specialist often include:

- Overseeing all marketing campaigns, from conception to completion

- Managing paid advertising across search, social, display, and other channels

- Coordinating email marketing and lead nurturing

- Tracking and reporting on conversions, attrition, and other key metrics

- Analyzing campaign performance and ROI to identify improvement areas

- Developing promotions, offers, and incentives to reduce CAC

- Supporting your sales team with high-quality, sales-ready leads

In effect, this manager optimizes your organization’s entire customer acquisition pipeline. This focused role ensures acquisition efforts don’t fall between the cracks of marketing and sales. It also brings consistent management, measurement, and optimization.

Consider adding a full-time customer acquisition position if your current staff lacks the bandwidth to properly tackle these responsibilities. The lift in conversion rates and drop in CAC from focused management typically justifies the investment in salary.

Why You Should Benchmark Your CAC Against Competitors and Industry Averages

While absolute CAC values provide useful clues, you really want to benchmark against relevant comparables. Industry CAC averages and numbers from direct competitors give the best indication if your customer acquisition costs are out of line.

Research suggests CAC varies significantly across industries. For example:

B2B SaaS – $239 average CAC

E-commerce companies – $86 average CAC

Business consulting firms – $533 average CAC

Factors like average customer value, purchase frequency, and more drive CAC differences between sectors.

It’s wise to compare your CAC for a particular customer profile against industry data. CAC far above the norm could signal inefficient acquisition efforts. While CAC well below industry benchmarks might indicate opportunities to scale up budgets or target more valuable customers.

Likewise, understanding competitors’ CAC gives a competitive edge. If their costs to acquire customers are much higher, you likely have room to invest more in customer recruitment. Lower competitor CAC may reflect superior positioning or tactics you can emulate.

In any case, relevant comparisons provide context to interpret your own CAC figures. Use available CAC info to gain perspective and find tactical advantages.

How to Improve Your Customer Acquisition Strategy

We’ve covered several tactics to reduce CAC. But improving your acquisition strategy requires a holistic approach. Follow these best practices for an integrated, effective customer acquisition process:

Define your ideal customer profile (ICP) – Personas, demographics, psychographics, common attributes, needs, and pain points.

Identify the best channels to reach your ICP – Consider paid and organic search, social platforms, referral networks, trade publications, events, etc.

Create tailored messaging and content for each channel – Align closely with your ICP’s needs, challenges, and interests.

Develop compelling offers, promotions, and lead magnets – Give ethical ‘bribes’ in exchange for contact information and sales conversations.

Build automated lead nurturing sequences – Drip email campaigns, personalized content, and incentives to convert cold prospects into sales-ready leads.

Track attribution and optimize budget allocation – Focus spending on the highest converting channels and campaigns.

Lower friction in your sales process – Evaluate every step through the prospect’s eyes. Remove hurdles to conversion.

Keep testing and improving – A/B test campaigns, pitches, pricing, and other variables to increase conversions.

Monitor metrics consistently – Track CAC, conversion rates, channel costs, win rates, etc. And take action on trends.

With these approaches, you’ll hone an efficient customer acquisition strategy that consistently minimizes CAC.

How to Reduce CAC by Improving Customer Experience

Beyond sales and marketing tactics, improving overall customer experience (CX) can also lower your customer acquisition cost.

How?

Because satisfied customers are more likely to:

- Purchase again, reducing re-acquisition costs

- Refer friends and colleagues, reducing referral CAC

- Leave positive reviews, reducing marketing costs

Good CX also means lower customer support costs. Happier clients require less service time and attention.

Here are some CX best practices that ultimately lower your CAC:

- Set clear expectations upfront – Avoid future disappointment or misunderstandings. Get the foundation right with new customers.

- Gather feedback often – Use surveys, calls, and reviews to stay on top of needs and pain points.

- Act quickly on complaints – Fixing issues promptly limits damage.

- Wow customers whenever you can – Use surprise and delight tactics to promote loyalty and referrals.

- Make it easy to get support – Have many self-service options and responsive live support. This plays a key role in customer retention.

- Highlight value delivered – Communicate ROI, benefits gained, and progress made.

- Send ‘touch’ emails and gifts – Occasional personal contacts on special occasions.

Excellent customer relationship management can help you drive higher satisfaction, referrals, retention, and reviews. The increased repeat business and word-of-mouth make acquiring new customers much more efficient and cost-effective.

Conclusion

Calculating customer acquisition cost gives you vital insights. CAC shows what parts of your sales and marketing work well or need fixing. Watch this number closely each month.

Is it going up or down? Dig into the reasons why and make the required changes to improve.

Use the powerful tips in this article to lower your cost per customer. You can get better at gaining customers profitably if you put in the required efforts. Don’t hurt your business by ignoring your marketing figures. Get more from your marketing dollars!

Smart companies always work on lowering their CAC. They boost what converts and cut what does not work. This fuels their growth and leaves competitors behind.

Of course, cutting CAC takes time and skill. This is where working with a digital marketing specialist like AdvertiseMint can help you. Our paid advertising services are tailored to deliver better ROI than what you are currently getting.

We can identify and optimize the best channels for your business to minimize CAC. Leverage our expertise to attract more ideal customers!

Want to learn how our targeted marketing services can reduce customer acquisition costs and accelerate your business growth?

Click here to book a hassle-free 30-minute consultation with us, and let’s get things rolling!