Love is in the air. As Valentine's Day approaches, Snapchat has unveiled key insights to help brands create impactful campaigns that resonate with users during this season of love. According to Statista, the number of Snapchat users in the USA is expected to reach a whopping 91.1 million in 2025. As … [Read more...]

The Complete Guide to Snapchat Emojis

Are you curious about Snapchat emojis? Snapchat has revolutionized communication by using emojis to signify different types of user interactions. Smiley face emojis are some of the most frequently used, each carrying its own unique meaning. This blog post will discuss Snapchat emoji meanings … [Read more...]

How To Stop Spam on Snapchat

Would you like to learn about spam Snaps? Spam Snaps are irrelevant or excessive snaps sent via Snapchat or other platforms. They have become a common annoyance for Snapchat's young audience. This blog post will explain the basics of Snapchat spam and how to avoid it. What is Snapchat Spam, … [Read more...]

What does the Red Heart on Snapchat Mean

Would you like to know the meaning of a red heart on Snapchat? The red heart on Snapchat often leaves users intrigued. Many users are curious about what the red heart emoji means on Snapchat. This article will discuss what the red heart and other Snapchat emojis mean. What are Snapchat … [Read more...]

How to Use Snapchat Like A Pro

Would you like to know how to use Snapchat? Are you a beginner wondering how to use Snapchat to send snaps, make video calls, view a friend's story, and more? This blog will break down the basics of getting the best out of the Snapchat app. What is the Snapchat App? Snapchat is a popular … [Read more...]

Snap Advanced Conversions Looks Promising, But How Does It Work?

What is Snap Advanced Conversions? Snap’s Advanced Conversions is a data collection, analysis, and reporting process that provides quality advertising services and conversions reports while respecting user privacy and the increasing restrictions around data tracking. Its strategy and how it works … [Read more...]

Snapchat Lowers Daily Minimum Spend to $5

Snapchat is making advertising more accessible to businesses. Now, you can advertise on the social media app at just $5 per day, the platform's new spending minimum. Since Snapchat advertising is an auction, your daily spend may fluctuate depending on your objective, budget, campaign duration, … [Read more...]

A Beginner’s Guide to Snapchat Marketing

Brands that target young consumers, specifically teens and young adults, should consider adding Snapchat to their marketing plans. Snapchat’s core audience is made up of millennials (born between 1980 and 1994) and generation Zs (born between 1995 and 2015). Ninety percent of people between the ages … [Read more...]

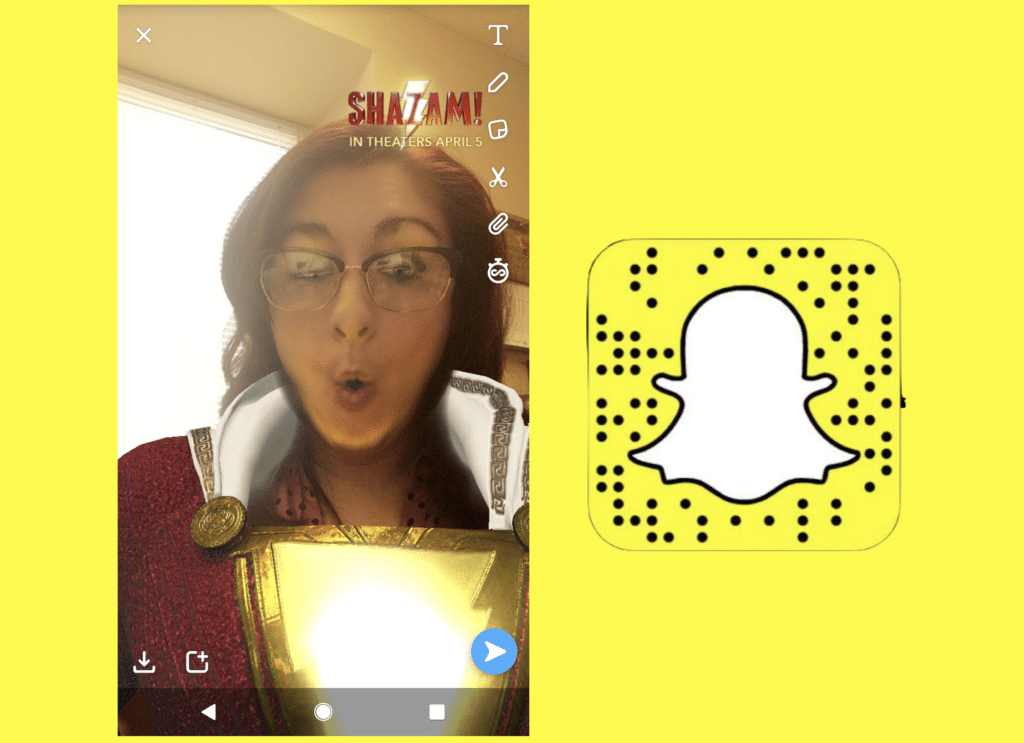

Snapchat Partners with Warner Bros. to Create First-Ever Voice-Activated Lens

In August, Snap announced its plans to create voice-activated AR experiences, but the company didn’t reveal details on how those AR experiences would work...until now. There’s a new voice-activating command joining the ranks of “Alexa” and “Okay, Google.” Snap just released its first-ever … [Read more...]

These Snapchat Advertising Updates Will Bring Cheer This Year

Anna Hubbel, writer at AdvertiseMint, Facebook advertising agency Snapchat is coming down the chimney with gifts for advertisers. Snap recently released two new updates to help advertisers better reach their audiences: a Lens Creative Partners Program and a Snapchat Ads Shopify app. Lens … [Read more...]

- 1

- 2

- 3

- …

- 9

- Next Page »